2021 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

| | | | | | 30 | | COMPENSATION DISCUSSION AND ANALYSIS | | |

OVERVIEW The Compensation Committee is composed entirely of independent directors, sets the Company’s executive compensation philosophy and reviews and approves compensation for executive officers, in consultation with the Compensation Committee’s independent executive compensation consultant. In this section, we describe and analyze: | (1) | the material components of our executive compensation programs for the “named executive officers” or “NEOs”; |

| (2) | the material compensation decisions the Compensation DiscussionCommittee made for 2023; and Analysis (continued) Executive Summary

| | | | | | | ● Our executive pay program aligns with long-term shareholder value creation. A significant portion of executive pay is performance-based, and subject to rigorous performance targets that are important to our shareholders.

●Initial decisions on our 2020 compensation plan were made prior to the COVID-19 pandemic. The compensation plan design and targets were established in January 2020, prior to the global emergence of the COVID-19 pandemic and the production shutdowns that ensued. The 2020 compensation plan design included certain changes in order to better align our compensation programs with shareholder interests, including increasing the weighting of relative TSR in our 2020-2022 long-term incentive program from 25% to 33%. In our annual incentive plan metrics, we replaced New Business Bookings with revenue Growth Over Market (“GOM”), a measure of relative revenue growth versus underlying global vehicle production. These changes strengthened alignment of our compensation programs to our strategic objectives, competitive market practices, and shareholder interests.

● All of our NEOs voluntarily reduced their base salary for the period from April 2020 through August 2020 in response to the financial pressures brought about by the COVID-19 pandemic. All NEOs also deferred their approved base salary increases until September 1, 2020.

● COVID-19 had a significant impact on achievement against both our short- and long-term original financial objectives. The impact of COVID-19, including global shutdowns, periods of reduced automotive demand, and the increased costs of keeping our employees safe rendered the previously established financial targets for our annual incentive plan and performance-based restricted stock units (“RSUs”) unachievable. In light of the Company’s strong operating and financial performance, including in response to COVID-19 and the unprecedented challenges it presented, and the extraordinary efforts of our employees and leaders around the world to enable the success of the Company following the onset of the COVID-19 pandemic, the Compensation Committee determined this outcome did not reflect our pay-for-performance philosophy.

● The Compensation Committee recognized the need to re-align the compensation programs in light of COVID-19. In response to management’s decisive actions to successfully respond to and generate strong results in light of the COVID-19 pandemic, the Compensation Committee evaluated changes to compensation programs. The key principles underlying the Compensation Committee’s consideration of compensation program changes were to:

Consider the welfare of our Consider the welfare of our employees first

Preserve Preserve value for our shareholders

Compensate and reward performance and value creation

Reduce pay opportunity in conjunction with Reduce pay opportunity in conjunction with adjusted goals

Cap long-term payouts at target if we do not outperform our peers

●In July 2020, the Compensation Committee prudently reset the goals and reduced payout opportunities in the Annual Incentive Plan. As the industry emerged from global shutdowns and the Company successfully restarted operations, the Compensation Committee approved the Updated Incentive Plan (as defined below) to motivate participating employees, including executives, and to encourage sustained focus on enterprise-wide goals. The Updated Incentive Plan provided reduced target and maximum incentive opportunities at 50% and 65% of original target payout, respectively.

| | | | 3-YEAR TSR

49.6%

89TH

PERCENTILE OF OUR TSR

PEER GROUP

BELOW TARGET

INCENTIVE PAYOUT

65%

ANNUAL INCENTIVE

95%

2018-2020 LONG-TERM

INCENTIVE

CEO BASE SALARY

REDUCTION

50%

BASE SALARY REDUCTION

FROM APRIL-AUGUST

2020

3 YEAR AVERAGE

SAY-ON-PAY

96%

| | |

| 2021 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

|

| (3) | Compensation Discussion and Analysis (continued)the key factors considered in making those decisions, including Company performance.

|

2023 YEAR IN REVIEW Company Financial and Business Performance Highlights.Our 2023 performance reflects increasing global vehicle production and our solid execution despite the global inflationary environment and North American OEM labor strikes. Our recent financial and business achievements include the following: | • | | ● | In December 2020, the Compensation Committee took thoughtful action to adjust long-term compensation programs in response to COVID-19. Due to the emergence of the COVID-19 pandemic and resultant impacts on the Company’s industry and operations in 2020, the Compensation Committee determined that it was reasonable and appropriate to truncate the performance period for the 2018-2020 performance cycle to measure achievement of the financial results based on actual and estimated financial performance as of December 31, 2019. In addition, adjustments were made to restore our 2019 and 2020 compensation programs’ intended effectiveness. Ensuring alignment of pay-for-performance with shareholder value creation remains a key focus and ensures that the management team is accountable for strategic and operational execution. The Compensation Committee made the following changes:Generating record new business awards of approximately $34 billion, representing program lifetime revenue, validating our industry leading portfolio of advanced technologies tied to the accelerating megatrends in our industry.

|

| • | | AdjustedDelivering strong revenue growth over the original 3-year financial performance objectives forprior year despite adverse impacts from the 2019 and 2020 performance-based RSU grants, while maintaining the overall plan design. The revised targets were established at levels that the Compensation Committee deemed rigorous and challenging, while acknowledging the current operating environment;

Reduced the maximum payouts for 2019 and 2020 performance-based RSU grants from 200% to 150%; with payouts capped at 100% if relative TSR is below median; and

Did not grant any new incremental awards.

● | Our 3-year TSR was 49.6% – at the 89th percentile of our TSR peer group, reflecting operational performance well above industry peers. Despite COVID-19 disruptions, our Company delivered strong shareholder returns in 2020, driven by its operating and financial performance to which our management team contributed significantly.

|

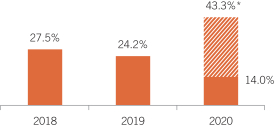

● | Even following these adjustments, our executives were awarded below-target short- and long-term payouts. Although the Company and its leadership exceeded expectations in navigating the unprecedented environment throughout 2020, the Compensation Committee acknowledged that the original targets were not achieved. Following the compensation program adjustments described above, our CEO earned 65% of his annual incentive target for 2020, and 95% of his target shares for the 2018-2020 long-term incentive award. In determining these levels, the Committee applied negative discretion to further align compensation earned by our executives with the austerity measures taken in 2020, including cost reduction and cash conservation actions, while recognizing the overall impact on our employees.North American OEM labor strikes.

|

| | | | | | | Plan| • | | Before Adjustments | | After Adjustments | | After Application

of Negative

Discretion | | | | | Annual Incentive Plan | | 10% payout (GOM) | | 65% payout | | 65% payout | | | | | 2018-2020 performance-based RSUs | | 49% payout | | 106% payout | | 95% payout |

● | Accounting guidelines distort the compensation reported in our 2020 Summary Compensation Table. The approved adjustments to 2019-2021 and 2020-2022 long-term incentive grants, while maintaining the value and intent of the original grants, require disclosure in the “Stock Awards” column of the “2020 Summary Compensation Table” as additional stock awards granted in 2020 due to the accounting impact of the program adjustments. For example, the amount disclosed in the “Stock Awards” column for our CEO of approximately $28.5 million reflects his original 2020 performance-based RSU grant as well as including the accounting impact of the adjustments approved in December 2020 to the 2019 and 2020 grants. What would typically be disclosed for this amount is approximately $10.7 million, which reflects the grant date fair value of the 2020 annual grant at the time it was made. Refer to the “Supplemental Compensation Information and Reconciliation” section below, which is provided in order to illustrate the implicit value of awards for our CEO after these adjustments.

|

| 2021 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT Producing a record $2.1 billion of adjusted operating income and record cash flow from operations of $1.9 billion, demonstrating strong operating execution in the face of the OEM labor disruptions and continuing material cost inflation.

|

| • | | Compensation Discussion and Analysis (continued)

2020 Year in Review

2020 Company Financial and Business Performance Highlights. COVID-19 affected nearly every facet of our operations. In spite of these impacts, our 2020 performance reflects our team’s dedication and efforts to ensure the health and safety of our employees first, while positioning the Company for flawless execution for our customers as operations resumed. Management’s actions preserved and enhanced Aptiv’s financial strength during the COVID-19 pandemic and generated strong returns following the restart of our global operations.

Our financial and business achievements in 2020 include the following:

StrengtheningFurther strengthening our balance sheet and liquidity position in order to continue to invest in value-enhancing opportunities, despite COVID-19by opportunistically paying off the outstanding principal balance of $301 million on the Tranche A Term Loan, Aptiv’s only variable rate borrowing.

|

Leveraging opportunistic market pricing dynamics and strong market demand by issuing $1.15 billion of ordinary shares and $1.15 billion of 5.50% preferred shares; and

Extending the maturity of substantially all of our existing revolving credit facility to August 2022.

Acting decisively in response to the global COVID-19 pandemic

Taking early and decisive actions to preserve our financial strength, including temporarily reducing executive pay, reducing capital expenditures, and suspending share repurchases and ordinary share dividends; and

Designing and successfully implementing our safe operations protocols, which enabled our facilities to restart safely and operate with zero production disruptions following the restart.

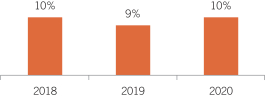

Generating strong results despite the COVID-19 pandemic

Delivering sustained outperformance, with 10% sales growth over market, attributable to our portfolio of leading technologies aligned with secular growth drivers;

Generating $1.621 billion of Adjusted EBITDA and cash flow before financing of $836 million, despite the COVID-19 pandemic’s negative impact on automotive production; and

Achieving 49.6% TSR over the period 2018 through 2020, illustrating our investors’ belief in our long-term strategy and current financial performance.

| • | | Continuing our relentless focus on cost structure and operational optimizationoptimization. |

Maximizing our operational flexibility and profitability by having approximately 97% of our hourly workforce based in best cost countries. | • | | MaximizingEnhancing our operational flexibility and profitability at all points in the normal automotive business cycle, by having approximately 97% of our hourly workforce based in best cost countries, and approximately 20% of our hourly workforce composed of contract and temporary employees; andoptimized full system, edge-to-cloud capabilities.

|

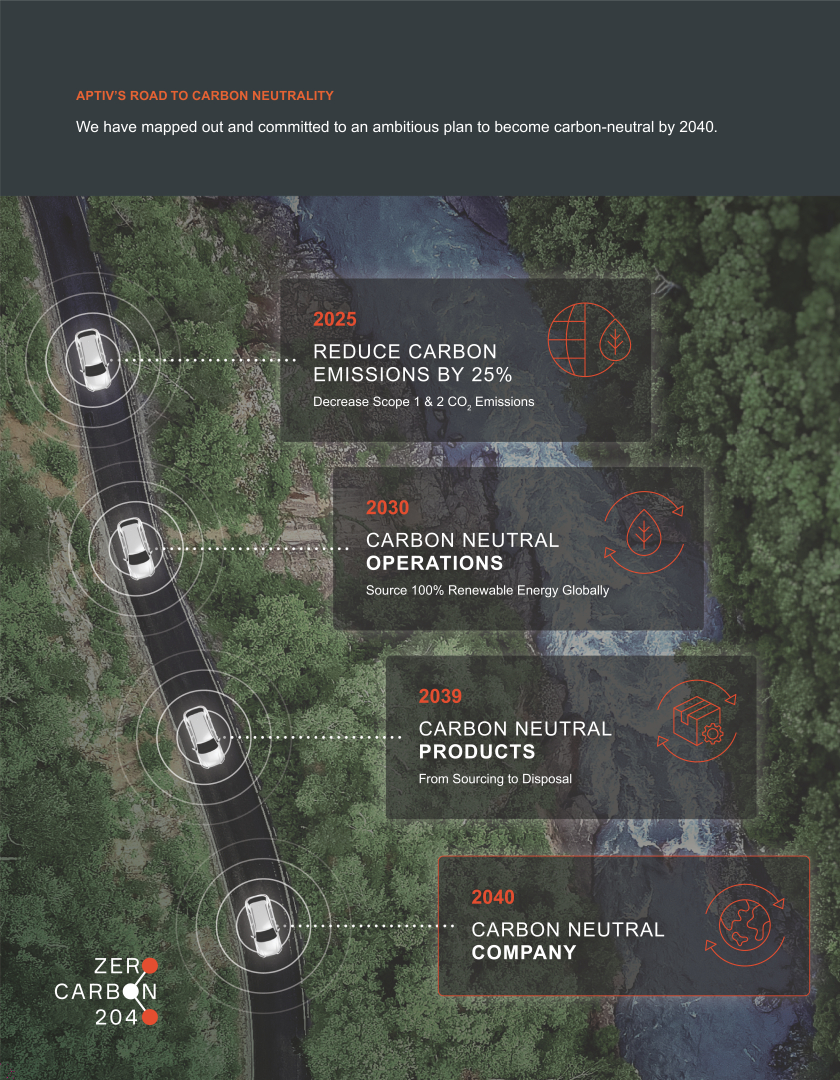

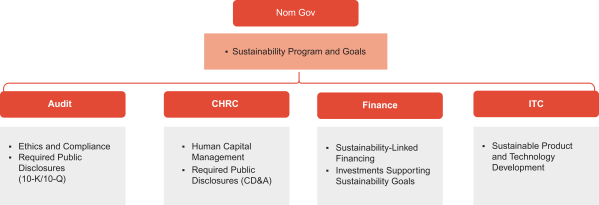

Increasing commercial traction, including new business awards that leverage the software product offerings of Wind River Systems, Inc. (“Wind River”) integrated with Aptiv’s full system solutions. | • | | RecruitingMeeting our sustainability-linked targets for greenhouse gas emissions and retaining top talent from various industries, including technology.workplace safety.

|

| | | | | | | COMPENSATION DISCUSSION AND ANALYSIS | | 31 |

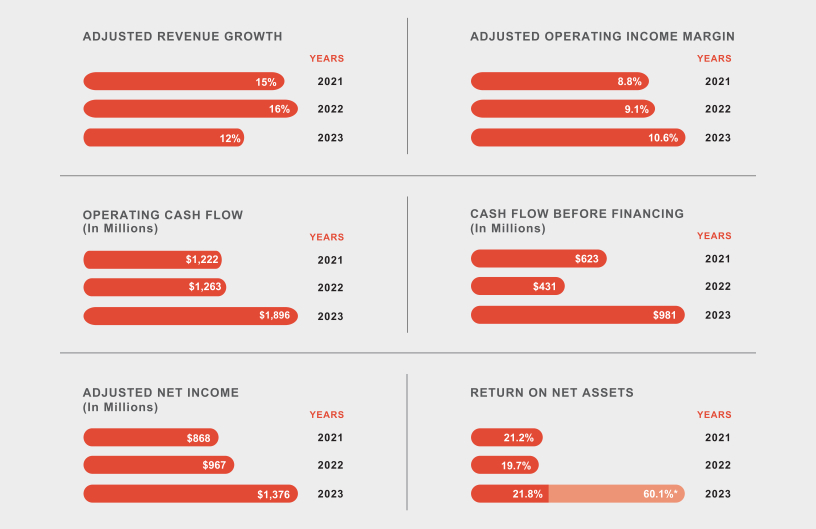

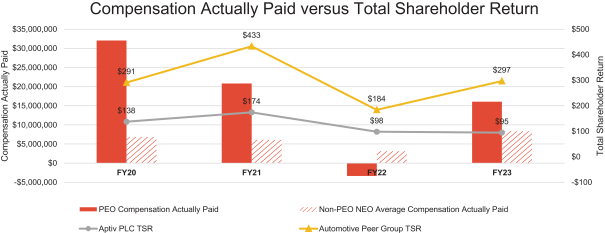

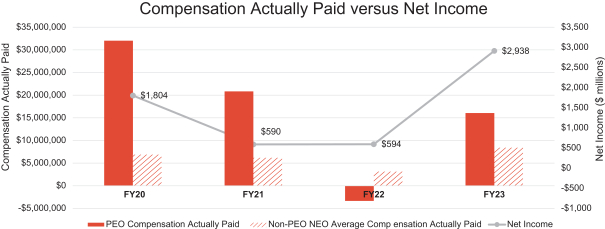

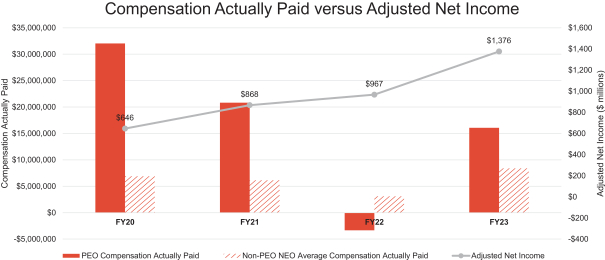

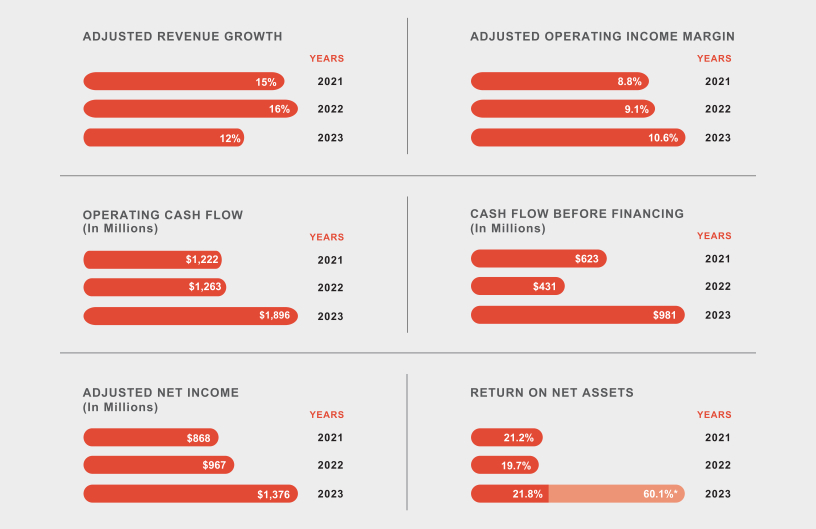

Our strong strategic, operational and financial performance over time is reflected in our results shown below.

| * | Continuing to executeReturn on our long-term Safe, Green and Connected strategy to enable a more sustainable future

Furthering our leadership positionnet assets in automated driving through2023 includes the formationimpacts of the Motional autonomous driving joint venture with Hyundai, which is focused$2.1 billion deferred tax benefit recognized from the Company’s initiation of changes to its corporate entity structure, including intercompany transfers of intellectual property and other related transactions. Excluding the impacts of these transactions, return on the design, development and commercialization of autonomous driving technologies;net assets was 21.8% in 2023.

|

Metric Definitions: Adjusted Net Income represents net income attributable to Aptiv before amortization, restructuring and other special items, including the tax impact thereon. Adjusted Operating Income is defined as net income before interest expense, other income (expense), net, income tax (expense) benefit, equity income (loss), net of tax, amortization, restructuring and other special items. Adjusted Operating Income Margin is defined as Adjusted Operating Income as a percentage of net sales. Adjusted Revenue Growth is defined as the year-over-year change in reported net sales relative to the comparable period, excluding the impact on net sales from currency exchange, commodity movements, acquisitions, divestitures and other transactions.

| | | | | | 32 | | COMPENSATION DISCUSSION AND ANALYSIS | | |

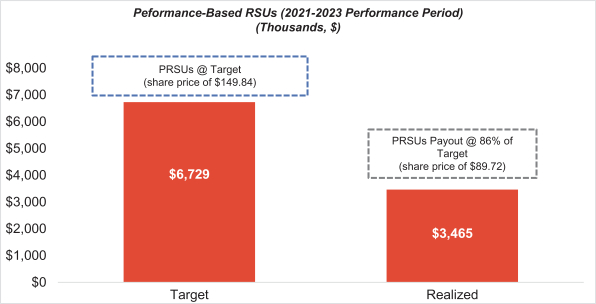

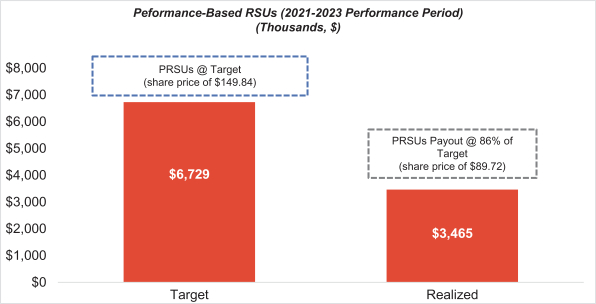

Cash Flow Before Financing represents cash provided by (used in) operating activities plus cash provided by (used in) investing activities, adjusted for the purchase price of business acquisitions and other transactions, the cost of significant technology investments and net proceeds from the divestiture of discontinued operations and other significant businesses. Return on Net Assets is defined as tax-affected operating income (net income before interest expense, other income (expense), net income tax expense, equity income (loss), net of tax), divided by average net working capital plus average net property, plant and equipment, measured each calendar year; not adjusted for restructuring expenses that are expected to provide future benefit to the Company. Appendix A contains a reconciliation of these numbers to U.S. GAAP financial measures. CEO REALIZED PAY AND OUR PERFORMANCE The compensation programs for our named executive officers are heavily weighted toward performance-based opportunities that are at-risk and subject to our performance. Incentive plan metrics are intended to drive results that create value for our shareholders. The chart below illustrates the relationship between Mr. Clark’s target performance-based long-term incentive award opportunity and the amounts he realized based on our performance against the metrics established for the performance period ended December 31, 2023. While our strong financial performance over the three-year performance period exceeded target, our stock price performance over the same period had a significant impact on how much value Mr. Clark realized from the target opportunity granted to him. This table supplements, but is not a substitute for, the information contained in the “2023 Summary Compensation Table” and the “2023 Pay Versus Performance Table”.

| • | | Expanding our market relevant portfolio to addressThe chart above depicts the industry’s top challenges, including high voltage electrification and active safety technologies; and

Significantly enhancing our commitment to corporate sustainability.

Appendix A contains a reconciliationTarget value of non-GAAP financial measures usedperformance-based RSUs granted in this disclosure to U.S. GAAP financial measures.

2020 Shareholder Engagement. Aptiv is committed to proactive engagement, communication, and transparency with shareholders. During 2020, we engaged institutional shareholders with respect to a variety of topics related to employee and board culture, board recruitment and refreshment, safety performance and sustainability efforts, and executive compensation. Raj Gupta,2021. The Realized value represents the Chairmanvalue of the Board and Chairman of the Compensation Committee, as well as members of management,

| 2021 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT 2021 performance-based RSUs that vested on December 31, 2023.

|

| • | | Compensation Discussion and Analysis (continued)

participated, as appropriate. In these meetings, we solicited feedback and provided information to our shareholders. We also specifically solicited insight regarding shareholder sentiment about potential adjustments to executive compensation programs.

In addition, membersTarget value reflects 44,910 target performance-based RSUs multiplied by grant date closing share price of management met with our investors throughout the year to discuss our businesses, technologies, end markets, financial results, operational execution and our sustainability efforts at numerous conferences and roadshows, in addition to Company-hosted events and quarterly conference calls. We also shared financial and ESG information relevant to our shareholders through our Sustainability Report, our Investor Relations website, our Annual Report and this Proxy Statement.

2020 Say-on-Pay. At our 2020 Annual Meeting of Shareholders, we received support from approximately 96% of votes cast as to our named executive officers’ compensation. Management and the Compensation Committee reviewed our shareholders’ 2020 Say-on-Pay vote and believe it to be a strong indication of continuing support for the Company’s executive compensation program and pay-for-performance philosophy. Therefore, the Compensation Committee maintained its overall pay-for-performance philosophy, compensation objectives and governing principles it has used in recent years when making decisions or adopting policies regarding executive compensation for 2020 and subsequent years. However, given the significant disruptions caused by COVID-19 after the establishment of 2020 executive compensation goals, the Compensation Committee and management believed it was important to solicit additional shareholder insight related to executive compensation practices related to COVID-19, as described above.

COVID-19 Impacts on Shareholders, Employees, and Executives. Our Board and management team took immediate and decisive actions in response to COVID-19 to protect the interests of many stakeholder groups, including employees, shareholders, customers, suppliers, and our communities.

For those actions that related to or impacted compensation, our Compensation Committee’s philosophy was simple:

Ensure our shareholders’ value is preserved and our non-executive employees’ compensation is addressed first, with our executives’ compensation adjusted afterward;

Reasonably adjust executive compensation for the impacts of COVID-19 on our outstanding compensation programs in order to preserve our pay-for-performance philosophy, and design these adjustments to be more resilient to potential future COVID-19 impacts;

Reduce pay opportunities in light of the updated metrics and targets following the impacts of COVID-19; and

Transparently report the compensation program adjustments.

| 2021 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT $149.84.

|

| • | | Compensation Discussion and Analysis (continued)

We believe we have been successful in following those principles. The table below sets forth the short-term impactsRealized value of the COVID-19 pandemic on our shareholders, our employees and our executives, andperformance-based RSUs represents a share price of $89.72 as of December 31, 2023 with a performance factor of 86%, as described in the status of these effects at the end of 2020.

| | | | | | | | | | | | | SHORT-TERM IMPACTS | | | | END-OF-YEAR IMPACTS | INCREASING

SHAREHOLDER

VALUE

| |

| | Temporary stock price decline

| |

| | Stock price reached all-time highs in Q4 2020

| |

| | Stock price on March 18th closed at $33.55, down 64% from the December 31, 2019 close

| |

| | At December 31, 2020, stock closed at

$130.29, resulting in a 2018-2020 TSR of 49.6%

| |

| | Dividend suspended in March 2020

| |

| | On a relative basis, our TSR performed at the 89th percentile within our TSR peer group

| CARING FOR

OUR

EMPLOYEES

| |

| | Temporary lay-offs for workers in production facilities aligned with customer and government-mandated shutdowns

| |

| | Approved a program to provide financial recognition to approximately 15,000 employees (excluding NEOs and other officers)

| |

| | Furloughs for salaried non-plant roles | |

| | Implemented previously-approved salary increases for salaried employees, effective September 1, 2020

| |

| | Suspension of annual salary increases | |

| | Reinstated Aptiv’s retirement plan contributions for US, Ireland, and Mexico employees, effective January 1, 2021

| |

| | Suspension of retirement plan contributions in the US, Ireland and Mexico | |

| | Shared Aptiv’s safety protocols with governments for adoption

| |

| | Implemented SAFE start protocols and contact tracing systems to keep our employees safe

| |

| | Provided PPE to our communities

|

| | | | |

| | Following mitigation of impacts of COVID-19 on shareholders and employees, the

Compensation Committee adjusted incentive programs to restore their motivational impact

and preserve our pay-for-performance philosophy

| |

|

| | | | | | | | | | | | | | | | | | RETAINING AND MOTIVATING OUR EXECUTIVES

| |

| | Voluntary base salary reduction of 50% by the CEO and 10% by our senior officers

| |

| | Adjusted incentive awards to restore intended motivational and retentive value and preserve our pay-for-performance philosophy

| |

| | Short- and long-term performance compensation programs decreased significantly in retentive and motivational value across all three outstanding long-term performance cycles

| |

| | Reduced upside potential in the 2020 short-term incentive award cycle and in the 2019 and 2020 long-term incentive award cycles

| | | |

| | Capped payouts at target if relative TSR is below median for the 2019 and 2020 long-term incentive cycles

“2021-2023 Performance-Based RSUs” discussion below. |

| 2021 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

|

Compensation Discussion and Analysis (continued)

Compensation Governance and Alignment with Shareholders

Aptiv’s executive compensation program is designed to attract, retain and motivate the leaders who drive the successful execution of our business strategies, which seek to balance achievement of targeted near-term results with building long-term shareholder value through sustained execution. Our focus on pay-for-performance and corporate governance aims to help ensure alignment with the interests of our shareholders, as highlighted below:

| | | | | | | Pay for Performance

| | More information

on page

|

| | 90% of 2020 total target annual compensation for the CEO is at risk and 75% is granted in equity, while, on average, 81% of 2020 target annual compensation for the other NEOs is at risk and 63% is granted in equity.

| | 33

|

| | We target executive compensation to approximate a competitive range around the market median (50th percentile) and deliver compensation above or below this level as determined by performance.

| | 34

| | | |

| | We use a structured goal-setting process for performance incentives, with multiple levels of review.

| | 39

|

| | NEOs’ annual incentives in typical years are based on achievement of Corporate, Segment and individual performance goals.

| | 39

|

| | 75% of the NEOs’ long-term incentive compensation consists of performance-based RSUs, which deliver value based on achievement of financial and relative TSR goals. The value of the remaining 25% of the NEOs’ long-term incentive compensation is awarded in the form of time-based RSUs and fluctuates with Aptiv’s share price.

| | 41

|

| | We review and analyze our pay-for-performance alignment on an annual basis.

| | —

| | | | | | | COMPENSATION DISCUSSION AND ANALYSIS | | 33 |

| | | | | | | Compensation Governance

| | More information

on page

|

| | We actively engage with our shareholders by conducting regular meetings with our major shareholders to discuss governance and executive compensation matters.

| | 29

|

| | We disclose our performance metrics.

| | 37

|

| | We maintain a reasonable severance practice with market appropriate post-employment provisions.

| | 44

|

| | We maintain stock ownership guidelines for our NEOs and directors.

| | 45

|

| | We maintain clawback, anti-hedging and anti-pledging policies.

| | 45

|

| | We offer no excise tax gross-ups or tax assistance unique to our NEOs.

| | 46

|

| | Our Compensation Committee utilizes an independent compensation consultant.

| | 46

|

| | Our compensation programs are designed to discourage imprudent risk.

| | 46

|

| | We devote focused time to leadership development and succession planning efforts.

| | —

|

| | Our equity grant practices, including burn rate and dilution, are prudent.

| | —

|

| | The Compensation Committee is provided tally sheets to assess total compensation for our NEOs.

| | —

|

OUR NAMED EXECUTIVE OFFICERS

| 2021 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

|

Compensation Discussion and Analysis (continued)

2020 Compensation Program Overview

Our Named Executive Officers

| | | For fiscal year 2020,

For fiscal year 2023, the NEOs were: | | | | | Kevin P. Clark | | Chairman and Chief Executive Officer (“CEO”) | | | Joseph R. Massaro | | Chief Financial Officer (“CFO”) and Senior Vice President, Business Operations | | | William T. Presley | | Senior Vice President and Chief Operating Officer, and President, Signal & Power Solutions | | | Obed D. Louissaint | | Senior Vice President and Chief People Officer | | | Benjamin Lyon | | Senior Vice President and Chief Technology Officer | | | Katherine H. Ramundo | | Senior Vice President, Chief Legal Officer, Chief Compliance Officer and Secretary | |

We have included Mr. Presley as an additional NEO given his role with Aptiv.

| | President and Chief Executive Officer (“CEO”)

| Joseph R. Massaro

| | Chief Financial Officer (“CFO”) and Senior Vice President, Business Operations

| David Paja

| | Senior Vice President and President, Advanced Safety and User Experience Segment

| David M. Sherbin

| | Senior Vice President, General Counsel, Chief Compliance Officer and Secretary (Mr. Sherbin is retiring from Aptiv effective April 1, 2021.)

| Mariya K. Trickett

| | | | | | 34 | | COMPENSATION DISCUSSION AND ANALYSIS | | |

COMPENSATION GOVERNANCE AND ALIGNMENT WITH SHAREHOLDERS Aptiv’s executive compensation program is designed to attract, retain and motivate the leaders who drive the successful execution of our business strategies. Our program seeks to balance achievement of targeted near-term results with building long- term shareholder value through sustained long-term performance. Our focus on pay-for-performance and corporate governance aims to achieve alignment with the interests of our shareholders, as highlighted below: Senior Vice President and Chief Human Resources Officer

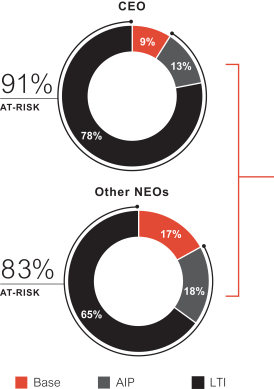

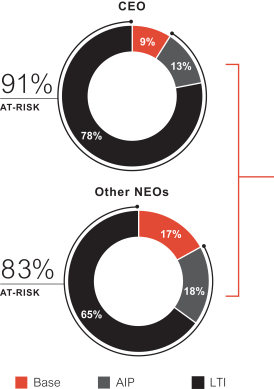

| | | | | | | Pay for Performance | | More Information On Page | | | |  | | 91% of 2023 total target annual compensation for the CEO is at risk and 78% is granted in equity; on average, 83% of 2023 total target annual compensation for the other NEOs is at risk and 65% is granted in equity. | | 37 | | | |  | | We use a structured goal-setting process for performance incentives, with multiple levels of review including the Compensation Committee, its consultant and senior management. | | 38 | | | |  | | NEOs’ annual incentives are typically based on achievement of multi-faceted financial and strategic annual performance goals. | | 38 | | | |  | | 60% of the NEOs’ long-term incentive compensation consists of performance-based RSUs, which deliver value based on achievement of multi-year financial and relative TSR goals. | | 43 | | | |  | | We review and analyze our pay-for-performance alignment on an annual basis, both in absolute terms and relative to our peer group. | | — |

| | | | | | | Compensation Governance | | More Information On Page | | | |  | | We actively engage with our shareholders to discuss governance and executive compensation matters. | | 34 | | | |  | | We maintain reasonable severance practices in line with market practices, including double-trigger change in control provisions. | | 45 | | | |  | | We maintain stock ownership guidelines for our NEOs and directors. | | 46 | | | |  | | We maintain insider trading, comprehensive clawback, anti-hedging and anti-pledging policies. | | 46 | | | |  | | We offer no excise tax gross-upsto our NEOs. | | 47 | | | |  | | Our Compensation Committee utilizes an independent compensation consultant. | | 47 | | | |  | | Our compensation programs are designed to discourage imprudent risk. | | — |

| | | | | | | COMPENSATION DISCUSSION AND ANALYSIS | | 35 |

EXECUTIVE COMPENSATION PHILOSOPHY AND STRATEGY General Philosophy in Establishing and Making Pay Decisions.Our executive compensation programs reflect our pay-for-performance philosophy and encourage executives to make sound decisions that drive short- and long-term shareholder value creation. The Compensation Committee utilizes a combination of fixed and variable pay elements in order to achieve the following objectives: | • | | Emphasize a pay-for-performance culture by linking incentive compensation to defined short- and long-term performance goals; |

| • | | In September 2020, Mr. Massaro’sAttract, retain and motivate key executives by providing competitive total compensation opportunities; and

|

| • | | Align executive and investor interests by establishing market- and investor-relevant metrics that drive shareholder value creation. |

Given the on-going transformation of our Company, we seek talent across a broad range of industries, including technology. Our goal for target total direct compensation (base salary, annual and long-term incentives) for our officers, including the NEOs, is to provide market competitive compensation that allows us to attract and retain the best global talent. Compensation for individual roles is based on a review of market data and multiple factors, including each executive’s role and responsibilities, the individual’s performance over time, the experience and critical skills the individual may bring to his or her role with Aptiv, and talent market dynamics. 2023 Say-on-Pay.At our 2023 Annual Meeting, we received support from approximately 77.7% of votes cast for our named executive officers’ compensation. Management and the Compensation Committee closely reviewed our shareholders’ 2023 Say-on-Pay vote and believe it indicates support for the Company’s executive compensation program and pay-for-performance philosophy. Based on this support, as well as with the feedback we have heard through our shareholder engagement efforts described below, the Compensation Committee has maintained the overall pay-for-performance philosophy, compensation objectives and governing principles it has used in recent years when making decisions or adopting policies regarding executive compensation. However, in response to specific feedback received from shareholders as part of Aptiv’s engagement efforts and to provide the relevant context for its compensation decisions, Aptiv has expanded this year’s Compensation Disclosure and Analysis disclosure to provide a greater level of detail about the compensation decisions taken by the Compensation Committee. 2023 Shareholder Engagement.Aptiv is committed to regular, proactive engagement, communication, and transparency with shareholders, which enables the Company to better understand shareholders’ perspectives about Aptiv and the market generally. As part of this commitment, we extended the opportunity to our top 25 shareholders representing approximately 53% of our then-outstanding shares, to meet with us in April 2023 prior to our 2023 Annual Meeting. Eight shareholders, representing over 26% of our then-outstanding shares, accepted our invitation and met with members of the Compensation Committee, along with our Chief Legal Officer, Chief People Officer and Vice President, Investor Relations, during these outreach sessions. The principal focus of the April engagement was executive compensation, and as described above we heard from our shareholders that they would appreciate disclosure of additional detail regarding compensation decisions. We again extended the opportunity to our top 25 shareholders representing approximately 52% of our then-outstanding shares in Fall 2023, for a discussion focused on stewardship with the same members of senior management that participated in the outreach in April. 13 of these shareholders, representing approximately 24% of Aptiv’s then-outstanding shares, accepted our invitation to meet at that time. While Aptiv was prepared to focus on executive compensation in these engagements, for the most part, shareholders preferred to discuss topics more generally related to sustainability and related topics, such as Aptiv’s path to carbon neutrality, supply chain management, talent development, and diversity and inclusion. The Board and management appreciated the constructive and positive input received from shareholders on all topics, which has continued to give us valuable insight into our shareholders’ priorities. We have and will continue to incorporate shareholder feedback into our practices. In addition to the formal outreach discussed above, members of management continue to have regular and extensive interaction with our investors throughout the year to discuss our businesses, technologies, end markets, financial results, operational

| | | | | | 36 | | COMPENSATION DISCUSSION AND ANALYSIS | | |

execution and our sustainability efforts at numerous conferences and roadshows, in addition to Company-hosted events and quarterly conference calls; in particular, in 2023, the Company hosted 290 investor calls, 13 investor conferences and 19 marketing/non-deal roadshow events. We have also shared financial and sustainability information relevant to our shareholders through our Sustainability Report, our Investor Relations website, our Annual Report and this Proxy Statement. 2023 Peer Group Analysis.We use a group of peer companies to compare NEO compensation to market. The Compensation Committee reviews and determines the composition of our peer group on an annual basis, with input from its independent compensation consultant and management. Aptiv’s 2023 peer group (referenced for purposes of 2023 compensation decisions) consisted of the following companies, whose aggregate profile was comparable to Aptiv in terms of size, industry, operating characteristics and competition for executive talent: | | | | | Amphenol Corporation | | Illinois Tool Works, Inc. | | | Corning Incorporated | | Johnson Controls International plc | | | Cummins, Inc. | | Lear Corporation | | | Eaton Corporation plc | | Rockwell Automation, Inc. | | | Emerson Electric Co. | | TE Connectivity Ltd. | | | Fortive Corporation | | Textron Inc. | | | Honeywell International Inc. | | Trane Technologies PLC |

No changes were made to the peer group referenced for purposes of our 2023 compensation decisions. In 2023, target total direct compensation among our NEOs, on average, was positioned within what we view as a competitive range of the peer group. In addition to the competitive market reference provided by our 2023 peer group, the Compensation Committee periodically uses supplemental market references from the technology sector for select roles to help prioritize building the leadership and technology skills within Aptiv that are fundamental to our ability to achieve our long-term strategy. One of the areas of highest focus has been on strengthening our product management, software development, artificial intelligence and machine learning, and systems engineering expertise. These skills are crucial to the development and deployment of next generation applications, cloud-native software, and sensor-to-cloud connectivity platforms which enable vehicles to efficiently evolve and improve over time. These capabilities are accelerating the commercialization of our Smart Vehicle Architecture (“SVA”) and other future full-systems solutions. These supplemental market references serve as an additional resource for the Compensation Committee to evaluate certain compensation decisions, where appropriate.

| | | | | | | COMPENSATION DISCUSSION AND ANALYSIS | | 37 |

2023 COMPENSATION PROGRAM OVERVIEW We regularly undertake a comprehensive review of our business plan to identify strategic initiatives that should be linked to executive compensation. We also assess the level of risk in our Company-wide compensation programs to ensure that they do not encourage imprudent risk-taking. The following table outlines the primary elements of executive compensation for the NEOs for 2023 and indicates how these elements relate to our key strategic objectives: | | | | | | Element | | Key Features | | Relationship to include responsibilityStrategic Objectives |  | | | | Annual Base Salary | | • Commensurate with job responsibilities, individual performance, experience, market competitiveness and talent market dynamics • Reviewed on an annual basis for global manufacturingmarket competitiveness and supply chain operations,individual performance | | • Attract and his title was updated in acknowledgementretain key executives by providing market-competitive fixed compensation | | | | Annual Incentive Plan Awards | | • Compensation Committee approves an incentive design for each performance period based on selected financial, operational and strategic metrics • Each executive is granted a target award opportunity based upon job responsibilities, individual performance, experience, market competitiveness and talent market dynamics • Payouts can range from 0% to 200% of this added role.target and are determined by achievement of pre-established financial goals and strategic objectives 2020

| | • Pay-for-performance and encourages accountability by rewarding achievement of corporate objectives • Align executive and shareholder interests • Motivate the pursuit of specific business goals that drive long-term value creation • Drive our current and future platforms and Aptiv’s sustainability commitments through strategic goals • Attract, retain and motivate key executives with market-competitive incentive compensation opportunities | | | | Long-Term Incentive Plan Awards | | • Target Annual Total Direct Compensation Mix.award granted commensurate with job responsibilities, individual performance, experience, market competitiveness and talent market dynamics • Grant RSU awards, 60% of which are earned based upon achievement of Company performance goals, including multi-year financial and relative TSR targets, and 40% of which vest over time | | • Pay-for-performance and encourages accountability by rewarding achievement of corporate objectives • Align executive and shareholder interests • Attract, retain and motivate key executives with market-competitive incentive compensation opportunities • Utilize multi-year vesting period and multiple metrics aligned to long-term shareholder value creation, including stock price performance |  | | | | Retirement Programs | | • Qualified defined contribution plan available to all U.S. salaried employees, including NEOs • Non-qualified defined contribution plan available to eligible U.S. employees, including NEOs, that allows for contributions that exceed statutory limits under our qualified defined contribution plan | | • Attract and retain key executives with market-competitive compensation opportunities that foster long-term savings opportunities |

| | | | | | 38 | | COMPENSATION DISCUSSION AND ANALYSIS | | |

Additional, non-primary elements of executive compensation, such as payments related to life insurance, tax preparation, expatriate assignments or relocation, may be provided to NEOs from time to time. Any of these elements that were provided to NEOs in 2023 are reflected in the “All Other Compensation” column of the “2023 Summary Compensation Table”. | | | | |  | | 2023 TARGET ANNUAL TOTAL DIRECT COMPENSATION MIX FOR CEO AND OTHER NEOS* Base salary and annual and long-term incentive award opportunities (all as more fully described below) are the elements of our NEOs’ total direct compensation. A majority of each NEO’s total direct compensation opportunity is comprised of performance-based (“at-risk”)pay, in line with the Committee’sCompany’s compensation philosophy. OurThe payouts of our annual incentive awards and the performance-based componentcomponents of our long-term incentive awards are considered performance-based pay, as the payout of these awards is dependent on the achievement of specified performance goals. The time-based portion ofAll our RSU awards, is retentive while also aligningboth time-based and performance-based, are aligned with Company performance, as the final value realized is based on the Company’s share price. The significant proportion of performance-based pay aligns the compensation interests of our NEO’s with those of Aptiv’s shareholders.

| |

|

| * | The mix of annual target direct compensation for our CEO and the average for our other NEOs on average in 2020, prior to the adjustments made to our executive compensation program in light of COVID-19 as described above,2023 is shown below:above. |

| | | | | | | COMPENSATION DISCUSSION AND ANALYSIS | | 39 |

| | | | | | | | | | | | | | | | | | | | | | | | 2023 NEO Target Total Direct Compensation Opportunities The following table depicts 2023 target annual total direct compensation opportunities for the NEOs. This table reflects base salary,

plus Annual and Long-Term Incentive Plan target award values, and therefore uses different valuation methodologies from those

required for purposes of the “2023 Summary Compensation Table” under applicable SEC rules. Further, this table does not include

information regarding changes in pension value and in non-qualified deferred compensation earnings, information regarding all other

compensation or certain additional footnote disclosure, each as required to be presented in the “2023 Summary Compensation Table”

under the rules of the SEC. As such, this table should not be viewed as a substitute for the “2023 Summary Compensation Table”. | | | | | | | Name | | Base Salary ($)(1) | | | Annual Incentive

Target Award ($) | | Long-Term Incentive Plan Target Annual Award ($) | | Total Direct Compensation ($)(2) | | | | | | | | | | | | Kevin P. Clark Chairman and Chief Executive Officer | | | $1,462,272 | | | | $2,193,408 | | | | $13,000,000 | | | | $16,655,680 | | | | | | | | | | | | | Joseph R. Massaro Chief Financial Officer and Senior Vice President, Business Operations | | | 1,275,000 | | | | 1,593,750 | | | | 5,750,000 | | | | 8,618,750 | | | | | | | | | | | | | William T. Presley Senior Vice President and Chief Operating Officer, and President, Signal & Power Solutions | | | 900,000 | | | | 900,000 | | | | 3,500,000 | | | | 5,300,000 | | | | | | | | | | | | | Obed D. Louissaint Senior Vice President and Chief People Officer | | | 750,000 | | | | 750,000 | | | | 3,000,000 | | | | 4,500,000 | | | | | | | | | | | | | Benjamin Lyon Senior Vice President and Chief Technology Officer | | | 800,000 | | | | 800,000 | | | | 2,900,000 | | | | 4,500,000 | | | | | | | | | | | | | Katherine H. Ramundo Senior Vice President, Chief Legal Officer, Chief Compliance Officer and Secretary | | | 775,000 | | | | 775,000 | | | | 2,300,000 | | | | 3,850,000 | | | | | | | | | (1) Reflects base salary rates as of April 1, 2023. (2) This table does not reflect the value of new hire awards for Messrs. Louissaint and Lyon, and a special award for Ms. Ramundo, which are discussed below. | | | |

2023 ANNUAL COMPENSATION DETERMINATION Individual base salaries and annual incentive targets for the NEOs are established based on the scope of each NEO’s responsibilities, individual performance, experience, market pay data and talent market dynamics. 2023 Base Salaries. Base salary is intended to be commensurate with each NEO’s responsibilities, individual performance and experience. Our practice is to make periodic adjustments to base salary, although we review compensation competitiveness annually. During 2023, the Compensation Committee approved base salary increases for two of our NEOs. Generally, these adjustments were intended to increase the market competitiveness of their compensation and to recognize the continued growth in their respective organizational responsibilities and exceptional performance. The following table summarizes the adjustments: | | | | | | | | | | | | | Name(1) | | Base Salary Adjustment Effective Date | | | Adjusted Base Salary ($) | | | Increase (%) | | | | | | Joseph R. Massaro | | | April 1, 2023 | | | $ | 1,275,000 | | | | 6.3 | % | | | | | Katherine H. Ramundo | | | April 1, 2023 | | | | 775,000 | | | | 14.6 | |

| (1) | Neither Mr. Clark nor Mr. Presley received a base salary increase in 2023. In connection with Mr. Presley’s promotion to Chief Operating Officer on December 15, 2022, he received a base salary increase to $900,000. Messrs. Louissaint and Lyon joined Aptiv on January 1, 2023 and December 28, 2022, respectively; as a result, neither of them was eligible for a base salary increase in 2023. | 33 | | APTIV PLC |

| | | | | | 40 | | COMPENSATION DISCUSSION AND ANALYSIS | | |

2023 Annual Incentive Plan Awards. Our Annual Incentive Plan is designed to motivate our NEOs to drive profitable growth, including earnings and cash flow, and our strategic priorities by measuring the NEOs’ performance against our goals. The Compensation Committee establishes the individual annual incentive target for each NEO at a market competitive level, based on the NEO’s position, individual performance, and the scope of his or her responsibilities. As designed, payouts based on the metrics described below can range from 0% to 200% of each NEO’s annual incentive target. The Compensation Committee, working with management and its independent compensation consultant, sets the performance metrics and objectives based on Aptiv’s annual business objectives. For 2023, each NEO’s award payout was designed to be determined as follows: NEO AIP Weighting

Financial Performance Objectives (75% Weighting).For 2023, financial performance objectives were based on the following metrics, which measure our overall financial performance in support of our business strategy: | | | | | Weighting (%) Performance Metrics | | 75% Financial | | Rationale | | | | Adjusted Net Income (NI)(1) | | 25% | | Adjusted NI provides a measure of our underlying earnings and serves as an indicator of our overall financial performance | | | | Cash Flow Before Financing (CFBF)(2) | | 25% | | CFBF measures the generation of cash required to gain scale in our current platforms and to pursue future platforms | | | | Growth Over Market (GOM) | | 25% | | GOM measures sales growth relative to the markets in which we operate and supports the conversion of bookings to revenue |

| (1) | Adjusted NI represents net income attributable to Aptiv before restructuring and other special items, including the tax impact thereon. |

| (2) | CFBFrepresents cash provided by (used in) operating activities plus cash provided by (used in) investing activities, adjusted for the purchase price of business acquisitions and other transactions, the cost of significant technology investments and net proceeds from the divestiture of discontinued operations and other significant businesses. | |

Performance Goal Setting. The NI, CFBF and GOM goals and the award payout levels related to the achievement of those goals are measured on a performance scale set by the Compensation Committee. Performance below the minimum threshold for a metric would result in no payout for that metric, and performance above the maximum level for a metric would be capped at a maximum total payout of 200% of target with respect to that metric. The Compensation Committee consistently sets performance targets that are rigorous and aligned with Aptiv’s three-year goal planning process and commitments to operational excellence. Our Annual Incentive Plan target goals, approved by the Compensation Committee, are generally established to reflect our focus on growth over prior year actual outcomes and above market growth in the performance period. Aptiv’s targeted levels of performance continue to reflect rigorous hurdles taking into account the challenging macroeconomic outlook and consistent with our goal of delivering exceptional operational performance. Given the ongoing market uncertainty and the goal-setting challenges associated with macroeconomic headwinds in January 2023, the Compensation Committee determined that the 2023 Annual Incentive Plan would include the following design changes:

2021 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

| | | | | | | COMPENSATION DISCUSSION AND ANALYSIS | | 41 |

| • | | The Compensation Committee widened the performance ranges by lowering the threshold performance level and increasing the maximum performance level. To balance the impact of these changes, the Committee lowered the possible payout for threshold performance from 40% to 25%. The Committee made these adjustments because in an uncertain market environment, executive leadership stability is paramount. |

| • | | Compensation Discussion and Analysis (continued)

2020 Target Compensation Structure.The following table depicts the initial 2020 target annual direct compensation opportunities for the NEOs. The amounts reflected in this table were determined by the Compensation Committee in January 2020, prior toapproved financial targets for two consecutive six-month financial performance periods, with one payout at the global spreadend of the COVID-19 pandemicfiscal year to address near-term macroeconomic and subsequent production shutdowns in China, North America and Europe duringsupply chain headwinds. The Compensation Committee believed that this structure would enhance visibility for goal setting purposes over a shorter horizon within the framework of the Board-approved annual financial plan. The Compensation Committee established performance criteria for the first half of 2020. This2023 (“H1 23”) and for the second half of 2023 (“H2 23”). Both H1 23 and H2 23 performance targets were consistent with the Board-approved annual financial plan. Despite the momentum in the business in the first half of 2023, during which Aptiv delivered results exceeding the H1 23 targets, the United Automobile Workers strike and subsequent vehicle production slow down created a more challenging performance environment in the second half of 2023, which impacted the Company’s financial results, as depicted in the table does not reflect the base salary reductions, deferrals of base salary increases, and reductions of target annual incentive plan awards that subsequently occurred during 2020 in light of COVID-19 and the resultant impacts on the Company. It also does not reflect the grant date fair valuebelow.

|

The 2023 corporate financial performance goals and results by metric for each of the two financial performance periods were: | | | | | | | | | | | Performance Metric* | | Performance

Period | | Threshold 25% Payout | | Target 100% Payout | | Maximum 200% Payout | | Achievement | Adjusted Net Income (NI) | | H1 23 | | | | | | Actual: $434M | | 200% | | |  | | | $222M | | $332M | | $425M | | | H2 23 | | | | Actual: $691M | | | | 99% | | |  | | | $463M | | $695M | | $888M | Cash Flow Before Financing (CFBF) | | H1 23 | | | | | | Actual: ($197M) | | 200% | | |  | | | ($423M) | | ($282M) | | ($220M) | | | H2 23 | | Actual: $946M | | | | 74% | | |  | | | $713M | | $1,070M | | $1,367M | Growth Over Market (GOM) | | H1 23 | | | | | | Actual: 7.5% | | 185% | | |  | | | 3.6% | | 5.4% | | 7.8% | | | Actual: (1.3%)

| | | | | | 0% | | | H2 23 | |  | | | 3.6% | | 5.4% | | 7.8% | | | | | | Financial Performance (% of Target) | | | | | | | | 126% |

| * | For purposes of the annual 2020 long-term incentive awards grantedAdjusted NI calculated results under the Annual Incentive Plan, to maintain the program rigor, the results shown in February 2020, orAppendix A of our Proxy Statement were adjusted to remove income earned by the Company on incremental accounting impact associated with adjustments made tosales volumes that were not anticipated at the outstanding performance-based equity awards during 2020, eachstart of which are discussed in further detail belowthe performance period and not included in the “Supplemental Compensation Information and Reconciliation” section. Further, this table does not include information regarding changesoriginal target. For purposes of the Cash Flow Before Financing calculated results under the Annual Incentive Plan, the results shown in pension value and non-qualified deferred compensation earnings, or information regarding all other compensation, each of which are presented in the “2020 Summary Compensation Table.” As such, this table should not be viewed as a substitute for the “2020 Summary Compensation Table.” | | | | | | | | | | | | | | | | | | Name | | Base Salary ($)(1) | | | Annual Incentive

Target Award ($) | | | Long-Term

Incentive Plan

Target Annual

Award ($) | | | Total ($) | | Kevin P. Clark | | $ | 1,462,272 | | | | $2,193,408 | | | $ | 11,000,000 | | | $ | 14,655,680 | | | President and Chief Executive Officer | | | | | | | | | | | | | | | | | Joseph R. Massaro | | | 935,000 | | | | 935,000 | | | | 3,700,000 | | | | 5,570,000 | | | Chief Financial Officer and Senior Vice President, Business Operations | | | | | | | | | | | | | | | | | David Paja(2) | | | 649,666 | | | | 552,216 | | | | 2,200,000 | | | | 3,401,882 | | Senior Vice President and President, Advanced Safety and

User Experience Segment | | | | | | | | | | | | | | | | | David M. Sherbin | | | 621,500 | | | | 559,350 | | | | 1,550,000 | | | | 2,730,850 | | | Senior Vice President, General Counsel, Chief Compliance Officer and Secretary | | | | | | | | | | | | | | | | | Mariya K. Trickett | | | 550,000 | | | | 467,500 | | | | 1,500,000 | | | | 2,517,500 | | | Senior Vice President and Chief Human Resources Officer | | | | | | | | | | | | | | | | |

(1) | Reflects base salary rates as of September 1, 2020, which were originally to be effective April 1, 2020. As described below, base salaries for the NEOs were reduced from April 2020 through August 2020 prior to the implementation of these base salary rates.

|

(2) | Mr. Paja is a German employee and his salary and bonus are paid in Euros. U.S. Dollar amounts in this Proxy Statement with respect to Mr. Paja have been converted from Euros at a rate of 1.14 Dollars to one Euro. The exchange rate used was calculated by averaging exchange rates for each calendar month in 2020.

|

General Philosophy in Establishing and Making Pay Decisions. Our executive compensation programs reflect our pay-for-performance philosophy and encourage executives to make sound decisions that drive short- and long-term shareholder value creation. The Compensation Committee utilizes a combination of fixed and variable pay elements in order to achieve the following objectives:

Emphasize a pay-for-performance culture by linking incentive compensation to defined short- and long-term performance goals;

Attract, retain and motivate key executives by providing competitive total compensation opportunities; and

Align executive and investor interests by establishing market- and investor-relevant metrics that drive shareholder value creation.

Given the transformationAppendix A of our Company, we seek talent across a broad rangeProxy Statement were adjusted to remove the impact of industries, including technology,M&A activity and

our goal for target total direct compensation (base salary, annual incremental sales volumes that were not anticipated and long-term incentives) for our officers, including the NEOs, is to approximate a competitive range around the market median (50th percentile). Compensation for individual roles may be positioned higher or lower than the market median where we believe it is appropriate, considering multiple factors such as each executive’s role and responsibilities, labor market dynamics, the individual’s performance over time, and the experience and critical skills the individual may bring to his or her role with Aptiv.

2020 Peer Group Analysis. We use a group of peer companies to compare NEO compensation to market. The Compensation Committee reviews and determines the composition of our peer group on an annual basis, considering input from its independent compensation consultant and management.

| 2021 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

|

Compensation Discussion and Analysis (continued)

Aptiv’s 2020 peer group consistedwere not part of the following companies, whose aggregate profile was comparable to Aptiv in terms of size, industry, operating characteristics and competition for executive talent.

| | | Amphenol Corporation

| | Illinois Tool Works, Inc.

| Corning Incorporated

| | Johnson Controls International plc

| Cummins Inc.

| | Lear Corporation

| Eaton Corporation plc

| | Rockwell Automation, Inc.

| Emerson Electric Co.

| | TE Connectivity Ltd.

| Fortive Corporation

| | Textron Inc.

| Honeywell International Inc.

| | Trane Technologies PLC

|

No changes were made to the 2019 peer group for 2020; however, Ingersoll-Rand plc was renamed Trane Technologies PLC.

In 2020, target total direct compensation among our NEOs, on average, was positioned within a competitive range of the peer group median identified above. We adjust compensation when we believe that there is a market or individualoriginal performance issue that should be addressed to preserve the best interests of the shareholders.

Elements of Executive Compensation. In line with our executive compensation philosophy, for 2020 we provided the following primary elements of compensation to our officers, including the NEOs:

Base salary;

Annual incentive award;

Long-term incentive award; and

Other compensation, such as participation by the NEOs in defined contribution retirement plans and benefits that are the same as those in which similarly situated non-officer employees may participate.

Additional, non-primary elements of executive compensation, such as payments related to life insurance, tax preparation, expatriate assignments or relocation, may be provided to NEOs from time to time. Any of these elements that were provided to NEOs in 2020 are reflected in the “All Other Compensation” column of the “2020 Summary Compensation Table”.

We regularly undertake a comprehensive review of our business plan to identify strategic initiatives that should be linked to executive compensation. We also assess and review the level of risk in our Company-wide compensation programs to ensure that they do not encourage imprudent risk-taking.

The following table outlines the primary elements of executive compensation for the NEOs for 2020 and indicates how these elements relate to our key strategic objectives:

| | | | | Element | | Key Features | | Relationship to Strategic Objectives | Total Direct Compensation

| Annual Base Salary

| | • Commensurate with job responsibilities, experience, and qualitative and quantitative company or individual performance factors

• Reviewed on a periodic basis for competitiveness and individual performance

• Targeted within competitive range of peer group

| | • Attract and retain key executives by providing market-competitive fixed compensation

| Annual Incentive Plan

Awards

| | • Compensation Committee approves a target incentive pool for each performance period based on selected financial and/or operational metrics

• Each executive is granted a target award opportunity based on level of responsibility and market competitiveness

• Payouts in a typical year can range from 0% to 200% of target and are determined by achievement of financial goals based on pre-established objectives (at both the Corporate and, where applicable, Segment level), then may be adjusted to reflect individual performance achievement

| | • Pay-for-performance

• Align executive and shareholder interests

• Motivate the pursuit of specific business goals that drive long-term value creation

• SRM reflects ESG metrics related to talent, culture and diversity outcomes, and quality

• Attract, retain and motivate key executives with market-competitive compensation opportunitiestarget.

|

| | | | | | 42 | | COMPENSATION DISCUSSION AND ANALYSIS | | | | 35 |

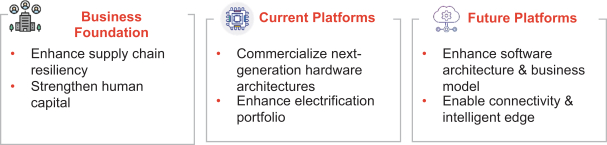

Strategic Results Metric (25% Weighting).In January 2023, the Compensation Committee decided to shift achievement on our strategic initiatives from a +/- 10% modifier (a design feature in previous Annual Incentive Plan performance periods) to a 25% weighted metric (“Strategic Results Metric”) for 2023 to reinforce the importance of our strategic goals in executing on our business strategy. The strategic goals under the Strategic Results Metric fall under the following three pillars and align with our broader strategic framework, including our sustainability program, and are intended to motivate focus across the organization on specific goals that drive long-term value creation. Aptiv’s strategic goals are reviewed with the same rigor and processes as the quantitative goal-setting described above, because these strategic goals are important to our ability to drive shareholder value creation.

Based on its holistic evaluation of our performance against our pre-established strategic goals, the Compensation Committee determined that a payout factor of 80% of target reflected the progress made and challenges faced in 2023 in relation to our Strategic Results Metric, as set forth in more detail below. | | | | | | | | | | | | | Strategic Results Metric | | | | | | | | | | | Business Foundation | | APTIV PLC |

| 2021 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

|

Compensation Discussion

| | | | | | | | | | | | | | | • Substantial enhancement in the transparency and Analysis (continued)depth of our supply chain, to manage risk proactively, as well as respond more effectively to unforeseen risk events. • Made progress in increasing leadership diversity, improving high performer retention and employee engagement, and scaling employee resource groups. Earned recognition from several external publications as a top employer. | | | | | Element | | Key Features | | Relationship to Strategic Objectives | | | • Strategic Results Modifier (“SRM”) provides for an adjustment to individual payout levels based on an assessment of performance against strategic qualitative factors reviewed and approved by the Compensation Committee at the beginning of each year

• For information on how the 2020 program was modified from our typical design, see “Executive Summary” above

| | | Long-Term Incentive Plan

Awards

| | • Target award granted commensurate with job responsibilities, market competitiveness, experience, and qualitative and quantitative Company and individual performance factors

• Grant RSU awards, 75% of which are earned based on Company performance metrics, including relative TSR, and 25% of which are time-based, which means that the value is determined by Aptiv’s share price

• For information on how the 2018, 2019 and 2020 programs were modified from our typical design, see “Executive Summary” above

| | • Pay-for-performance

• Aligns executive and shareholder interests

• Attract, retain and motivate key executives with market-competitive compensation opportunities

• Utilizes multi-year vesting period and metrics aligned to long-term shareholder value creation including stock price performance

| Other Compensation

| Retirement Programs

| | • Qualified defined contribution plan available to all U.S. salaried employees, including NEOs

• Non-qualified defined contribution plan available to eligible U.S. employees, including NEOs, who exceed statutory limits under our qualified defined contribution plan

• Non-qualified defined benefit plan that was frozen in 2008

• For information on certain changes in effect during 2020 regarding these programs, see “COVID-19 Impacts on Shareholders, Employees, and Executives” above

| | • Attract and retain key executives with market-competitive compensation opportunities

| | | | | | | | | Current Platforms | |  | | | | | | | | | | | | | | | • Exceeded bookings targets, with key awards across geographies and customers to gain momentum with deliverables and SVA bookings. • Achieved development milestones for power electronics and key software products. | | | | | | | | | Future Platforms | |  | | | | | | | | | | | | | | | • Integrated Wind River, progressed on synergy targets, cross business product development, internal usage of Wind River Studio, and growth of Wind River revenue. | | | | | | | | • Achieved development milestones for Aptiv software architecture; increased bookings pipeline; on-track with product roadmaps for ADAS, cockpit and middleware. | | | | | | | | | | Strategic Results Metric (% of Target) | | 80% | | |

| 2021 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

|

Compensation Discussion and Analysis (continued)

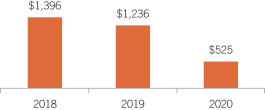

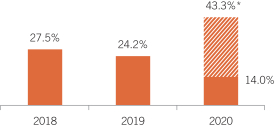

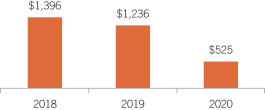

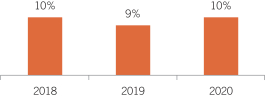

Alignment of Incentive Plans. We have aligned our 2020 performance-based annual and long-term incentive plans for executives with metrics on which the Company and its shareholders evaluate performance. The impact of COVID-19 on the Company’s 2020 performance is illustrated in the below financial metrics. Although the COVID-19 pandemic and the resultant impacts on the Company’s industry led to overall declines in most financial metrics as compared to prior years, the Company was able to take decisive actions as the

COVID-19 pandemic emerged that positioned us to generate positive financial returns following the resumption of global vehicle production. The Company’s successful response to the COVID-19 pandemic was reflected in the total shareholder returns delivered over the past 3 years. We have considered adjustments to our 2020 performance-based annual and long-term incentive programs for executives based on these metrics:

| | | | | | | Adjusted Net Income

(In Millions)

| | Cash Flow Before Financing

(In Millions)

|  | |  |

| | | Adjusted EBITDA

(In Millions)

| | Growth over Market

|  | |  | | | COMPENSATION DISCUSSION AND ANALYSIS | | 43 |

| | | Total Shareholder Return

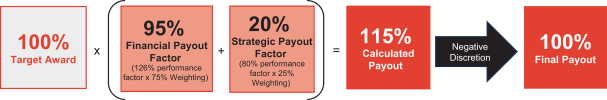

2023 Annual Incentive Plan Payouts.The 2023 Annual Incentive Plan payouts for our CEO and other NEOs were based 75% on corporate financial performance and 25% on strategic goals. Initial Calculated Results. In determining the final payouts, the Compensation Committee evaluated our financial performance against identified threshold, target and maximum levels of corporate financial performance goals, which resulted in a calculated score of 126% of the target described above. Our Strategic Results Metric payout factor of 80% of target was determined by the Compensation Committee in its sole discretion, and reflected the Compensation Committee’s evaluation of the progress made on our strategic initiatives year-over-year, while recognizing that not all our goals were achieved. On a weighted basis, as shown below, the calculated payout score was 115% of target. Exercise of Negative Discretion. Despite strong performance in achieving the Company’s financial targets and the Company’s leadership team making significant progress on the Company’s strategic priorities in 2023, the Compensation Committee considered Aptiv shareholders’ experience and decided to exercise negative discretion to reduce the initial calculated payout score (115%) earned by the NEOs to 100% of target. (2018 through 2020)

| | Return on Net Assets

|  | |  |

* | The increase in return on net assets in 2020 is attributable to the $1.4 billion gain recognized on the formation of the Motional autonomous driving joint venture. Excluding the gain on the Motional joint venture, return on net assets was 14.0% in 2020, reflecting continued investments for revenue growth and profitability, as well as the impacts of the COVID-19 pandemic on the Company’s industry and operations.

As a result of the analysis described above, the Compensation Committee approved the following 2023 Annual Incentive Plan payouts for the NEOs. |

| | | | | | | | | Name | | Calculated Incentive Award Payout (115%) ($) | | | Impact of Negative Discretion (from 115% to 100%) | | Actual Payment ($) | | | | | Kevin P. Clark | | | $2,522,419 | | | ($329,011) | | $2,193,408 | | | | | Joseph R. Massaro | | | 1,832,813 | | | (239,063) | | 1,593,750 | | | | | William T. Presley | | | 1,035,000 | | | (135,000) | | 900,000 | | | | | Obed D. Louissaint | | | 862,500 | | | (112,500) | | 750,000 | | | | | Benjamin Lyon | | | 920,000 | | | (120,000) | | 800,000 | | | | | Katherine H. Ramundo | | | 891,250 | | | (116,250) | | 775,000 |

| 2021 NOTICE OF ANNUAL MEETING AND PROXY STATEMENT

|

Compensation Discussion and Analysis (continued)

| | | | | | 44 | | COMPENSATION DISCUSSION AND ANALYSIS | | |

2023 LONG-TERM INCENTIVE COMPENSATION Performance Metrics. Aptiv’s Long-Term Incentive Plan is designed to reward performance on long-term strategic metrics and to attract, retain and motivate participants. Aptiv’s Long-Term Incentive Plan is primarily performance-based, with 60% of the NEOs’ award consisting of performance-based RSUs, which deliver value if financial and relative TSR goals are met. The targets reflect Aptiv’s pay-for-performance culture, which help align executive and investor interests. The remaining 40% are time-based RSUs, the value of which fluctuates with Aptiv’s share price performance. The performance-based RSUs are settled after the results of a three-year performance period are determined. The time-based RSUs generally vest ratably over three years, beginning on the first anniversary of the grant date. The 2023 performance-based RSU grant vests at the end of 2025 and will be settled in early 2026 after the outcomes of the performance period are determined and approved. Under the design of the performance-based RSU awards, each NEO could receive from 0% to 200% of his or her target performance-based RSU award, as determined by Aptiv’s performance against certain Company-wide performance metrics. The metrics and weights used in the 2023 awards are: | | | | | Metric Definitions | | Weighting (%) | | | Adjusted EBITDA represents net income before depreciation and amortization (including asset impairments), interest expense, other income (expense), net, income tax (expense) benefit, equity income (loss), net of tax, restructuring and other special items.

Average Return on Net Assets (RONA)(1) | | | 33.3 | % | | | Cumulative Net Income (NI)(2) | | | 33.3 | | | | Relative Total Shareholder Return (TSR)(3) | | | 33.3 | |

| (1) | Average RONA is defined as tax-affected operating income [net income before interest expense, other income (expense), net, income tax expense, equity income (loss), net of tax, divided by average net working capital plus average net property, plant and equipment measuredfor each calendar year; notyear, as adjusted for incentive plan calculation purposes. |

| (2) | Cumulative NI represents net income attributable to Aptiv before restructuring expenses that are expected to provide future benefit toand other special items, including the Company.tax impact thereon. |

| (3) | Total Shareholder ReturnRelative TSR is measured by comparing the average closing price per share of the Company’s ordinary shares for all available trading days in December 2025 to the average closing price per share of the Company’s ordinary shares for all available trading days in December 2022, including the reinvestment of dividends, relative to the companies in the Russell 3000 Auto Parts Index.

|

2023 Grants. The Compensation Committee established the following 2023 target long-term incentive award values for our NEOs (consisting of performance-based RSUs and time-based RSUs, as described above). In so doing, the Compensation Committee considered market compensation benchmarks and each NEO’s scope of responsibilities, individual performance and retention considerations. Mr. Presley’s year-over-year increase in target long-term incentive value was connected to his promotion to Chief Operating Officer role, effective December 15, 2022. | | | | | | | | | | | | | Name | | Performance-Based RSUs ($ at Target) | | Time-Based RSUs | | Total Long-Term Incentive Plan Target Annual Award ($) | | | | | Kevin P. Clark | | | $7,800,000 | | | | $5,200,000 | | | | $13,000,000 | | | | | | Joseph R. Massaro | | | 3,450,000 | | | | 2,300,000 | | | | 5,750,000 | | | | | | William T. Presley | | | 2,100,000 | | | | 1,400,000 | | | | 3,500,000 | | | | | | Obed D. Louissaint | | | 1,800,000 | | | | 1,200,000 | | | | 3,000,000 | | | | | | Benjamin Lyon | | | 1,740,000 | | | | 1,160,000 | | | | 2,900,000 | | | | | | Katherine H. Ramundo | | | 1,380,000 | | | | 920,000 | | | | 2,300,000 | |

In addition to their respective annual long-term incentive awards, Messrs. Louissaint and Lyon were awarded new hire equity awards, both granted in February 2023. These awards were granted to keep Messrs. Louissaint and Lyon whole for the cash and equity incentive compensation that each forfeited at their prior employers in order to join Aptiv. Mr. Louissaint, who joined Aptiv from IBM, received a new hire award comprised of time-based RSUs, which has a target value of $8,000,000, and vests ratably (33.3% per year) over three years in October 2023, 2024, and 2025. Mr. Lyon, who joined Aptiv from Astra Space, a provider of space products and launch services to the global space industry, following a 20-year career at Apple, received a new hire award comprised of time-based RSUs, which has a target value of $8,000,000, and vests ratably (50% per year) over two years in February 2024 and 2025.

| | | | | | | COMPENSATION DISCUSSION AND ANALYSIS | | 45 |

Ms. Ramundo was also granted a special equity award in addition to her 2023 annual long-term incentive award. The special equity award was granted in February 2023, has a target value of $2,000,000, and vests ratably (50% per year) over two years on each of February 2024 and 2025. This award was granted to recognize Ms. Ramundo’s extraordinary efforts to accelerate the closure of our Wind River transaction and effective management of the regulatory challenges in multiple geographies, which effectively accelerates our path to the fully-electrified software-defined vehicle. 2021-2023 Performance-Based RSUs. The Compensation Committee assessed the performance awards granted in February 2021 for which vesting was based on achievement of three-year cumulative performance through December 31, 2023. In February 2024, we paid out the performance-based RSUs for the 2021-2023 performance period. The following tables set forth: (1) the threshold, target and maximum levels, as well as the performance level achieved during the performance period; and (2) for each NEO, the target number of performance-based RSUs and actual number of performance-based RSUs earned. | | | | | | | | | | | | | | | | | | | | | Performance Metric | | Weight | | | Threshold 40% Payout | | | Target 100% Payout | | | Maximum 200% Payout | | | Achievement (% of Target) | | | | | | | Average Return on Net Assets (RONA)(1),(2) | | | | | | | | | | | Actual: 27.7% | | | | | | | | | 33.3% | | | |  | | | | 113% | | | | | | | | | 20.9% | | | | 26.9% | | | | 31.4% | | | | | | | | | | | | | | | | | Actual: $3,551M | | | | | | Cumulative Net Income (NI)(2) | | | 33.3% | | | |  | | | | 144% | | | | | | | | | $2,514M | | | | $3,232M | | | | $3,771M | | | | | | | | | Actual: 24th | | | | | | | | | | | | | | Relative Total Shareholder Return (TSR)(3) | | | 33.3% | | | |  | | | | 0% | | | | | | | | | 30th | | | | 50th | | | | 90th | | | | | | | | | | | Total Weighted Financial Performance Payout | | | | | | | | | | | | | | | | 86% | |

| (1) | Average RONA is tax-affected adjusted operating income divided by average net working capital plus average net property, plant and equipment for each calendar year, as adjusted for incentive plan calculation purposes. |